Credit Reports: GDS And TDS (We Swear It’s Not Alphabet Soup!)

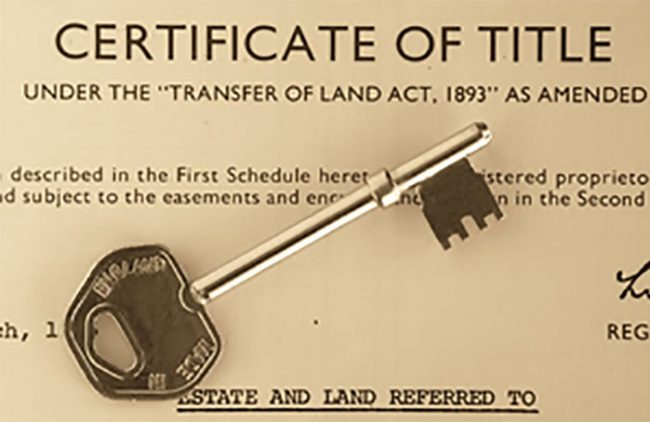

CREDIT REPORTS: GDS AND TDS (WE SWEAR IT’S NOT ALPHABET SOUP) What does it mean to be “qualified”? The word “qualified” gets tossed around a lot when people talk about financing, but what exactly does it mean to be qualified in a financial sense, and how do lenders make that determination? The primary calculations that…